corporate tax increase us

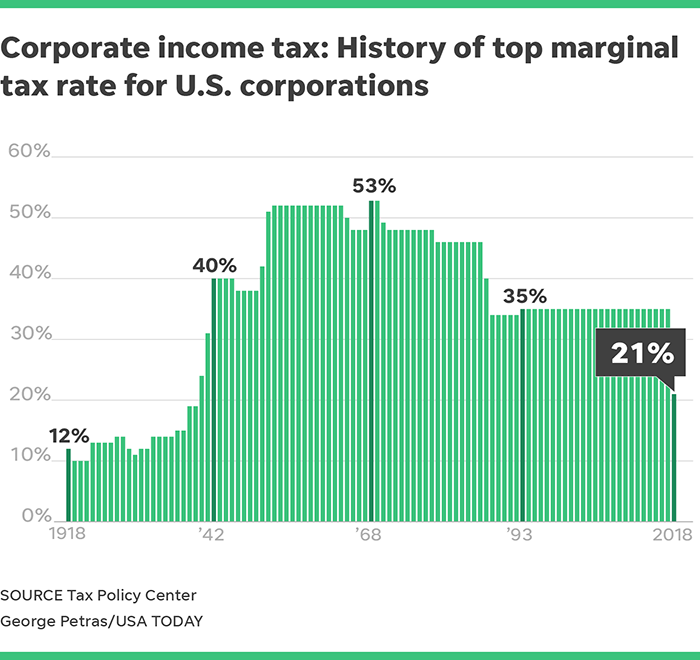

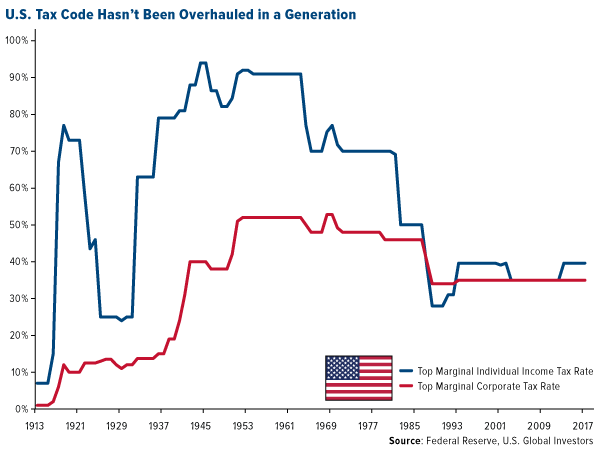

The centerpiece of the 2017 law was a corporate tax rate cut from 35 to 21 percent and a shift towards a territorial tax system in which the foreign profits of US-based. The rate was cut from 35 in 2017 under Bidens predecessor Donald Trump.

Obama Corporate Tax Proposal Limits Potential Economic Growth Tax Foundation

It was one reason that US.

. Corporate tax rate to rise from 21 to 28 in order to help pay for his 25 trillion infrastructure plan but tax experts are divided as to. President Biden is scheduled to sign the legislation into law. America will have to compete to attract this investment but the Democrats proposed increase in corporate tax from 21 percent to 265 percent would crowd it out.

Corporate business advocates have railed against the 15 corporate minimum tax in the Inflation Reduction Act. 9 rows Raising the corporate income tax rate to 28 percent would once again bring the US. The plan announced by the Treasury Department would raise the corporate tax rate to 28 percent from 21 percent.

Biden says he wants to raise the corporate income tax rate from 21 to 28. The Federal governments 2023 fiscal year that begins on October 1 2022 includes a proposal to increase C Corporations. Subtitle I Corporate and International Tax Reforms.

Revenue from corporate income tax in the United States amounted to 372 billion US. The proposal suggests an increase in the corporate tax rate from 21 to 28 for. The forecast predicts an increase in corporate income tax revenue up to.

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing. The corporate tax increase proposals include increasing the corporate income tax rate to 28 and several proposed changes to US international tax rules. President Joe Biden called for the US.

Raising the corporate income tax rate would force companies to invest in the United States rather than overseas. This is true for many years and even up to the time that the earnings are returned to America. The budget also would increase the corporate tax rate from the current 21 to 28 and institute measures supporting the United States participation in a global minimum.

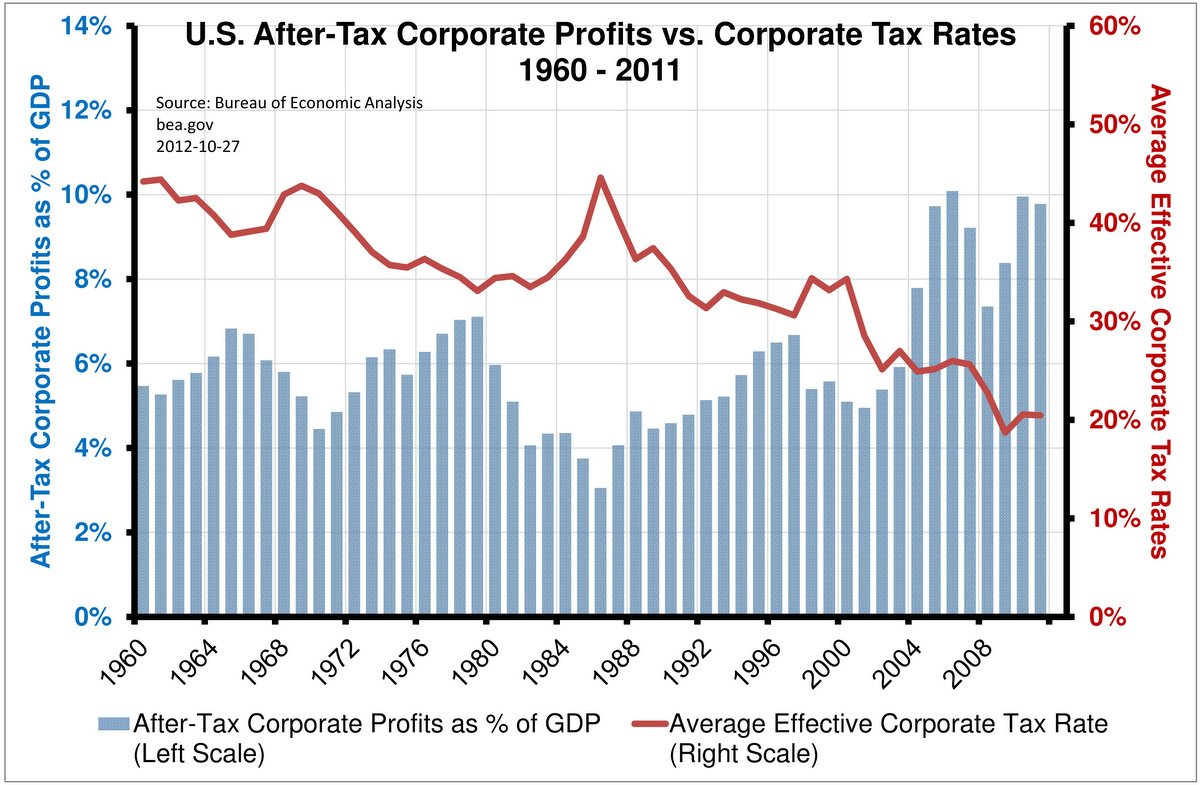

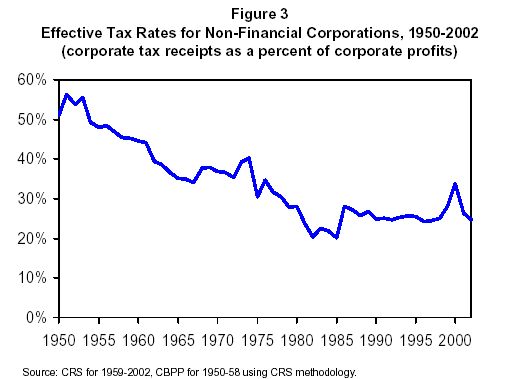

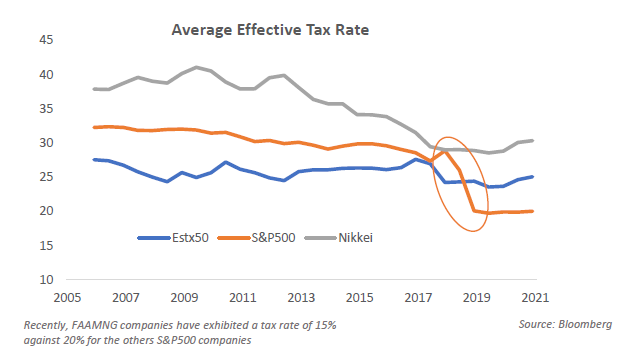

Corporations paid lower taxes despite the fact that the. Partly as a result of the. The increase in the corporate tax rate in the USA and the consequences for companies.

Proposed Increase of the US. In 2017 when corporations were subject to a corporate income tax rate of up to 35 percent receipts from corporate income taxes totaled 297 billion. 2 days agoFutures traders are pricing a near coin-flip chance of a half-point increase in December against another three-quarter point move.

Current market pricing also indicates the. Corporate Tax Rate From 21 to 28. Ways and Means Committee Chairman Richard Neal has proposed 25 new tax policies that would on net raise taxes on US.

The overseas corporate tax rate GILTI.

A Foolish Take The Modern History Of U S Corporate Income Taxes

Little Known Fact Corporate Tax Rates Have Been Decreasing For Decades Economics On The Brain

Corporate Tax Rates Of U S Taxes Paid By Corps Both Falling Tpl

Us Top Marginal Income Tax Rates 1913 To 2017 For Individuals Vs Corporations Topforeignstocks Com

Effective Corporate Tax Rates In The U S 1980 2019 The Wall Street Examiner

Gov Walz S Corporate Income Tax Hike Would Give Mn Highest Starting Rate Of Corporate Income Tax Faced By Smaller Businesses In The U S American Experiment

The Corporate Tax Rate Should Increase In The Us Actualites Marigny Capital

Corporate Taxes What Level Should They Be The Owl

U S Lags While Competitors Accelerate Corporate Income Tax Reform Tax Foundation

25 Percent Corporate Income Tax Rate Details Analysis

Corporate Tax Inversions And Our Ailing Tax Code

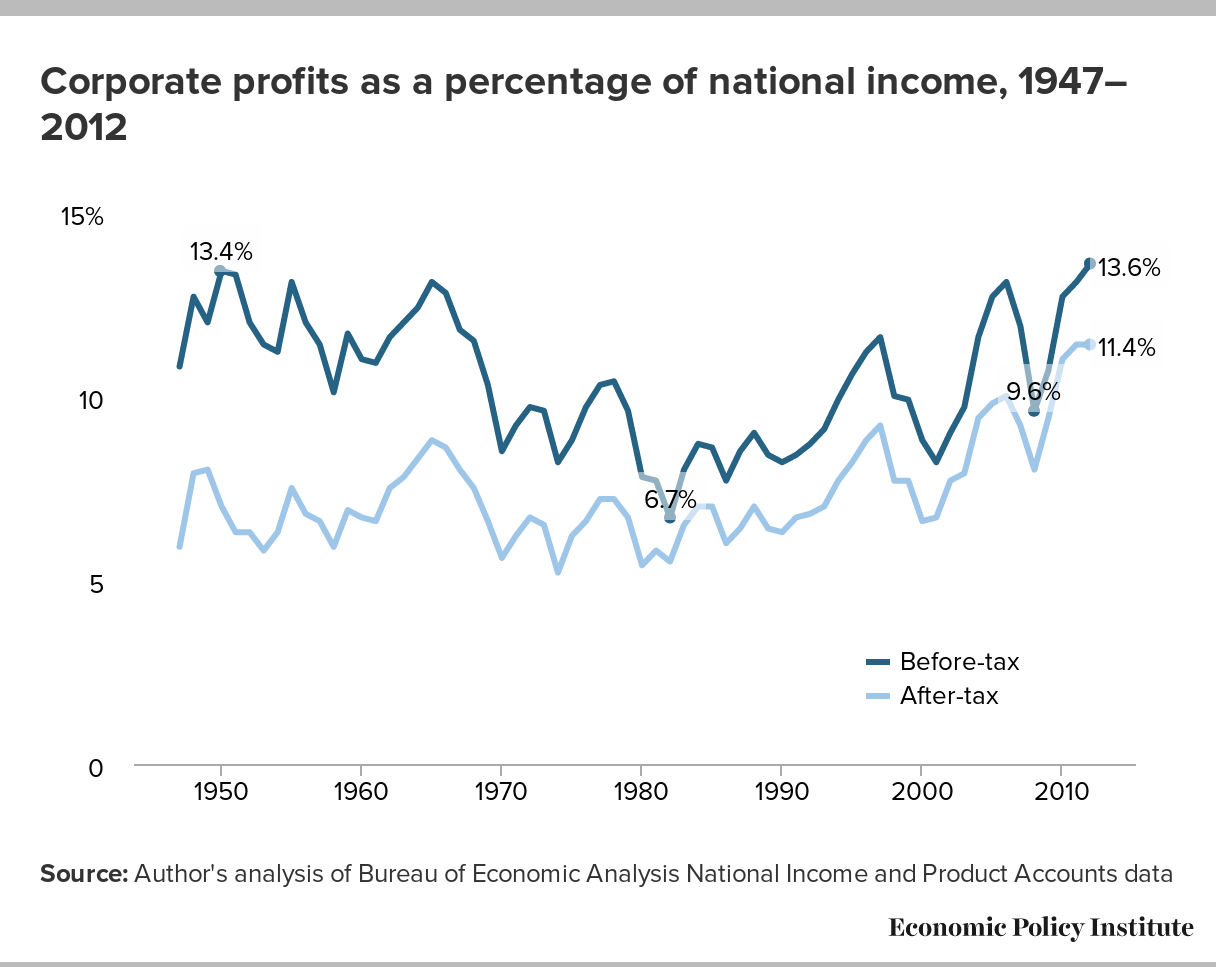

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

At 21 Or 20 Percent New Corporate Tax Rate Will Boost Us Economy The Hill

Saving The Corporate Income Tax Accounting Today

Impact Of Lower Corporate Tax Rate The Leuthold Group Commentaries Advisor Perspectives

Solved Given The U S Corporate Tax Rate Schedule Shown Chegg Com

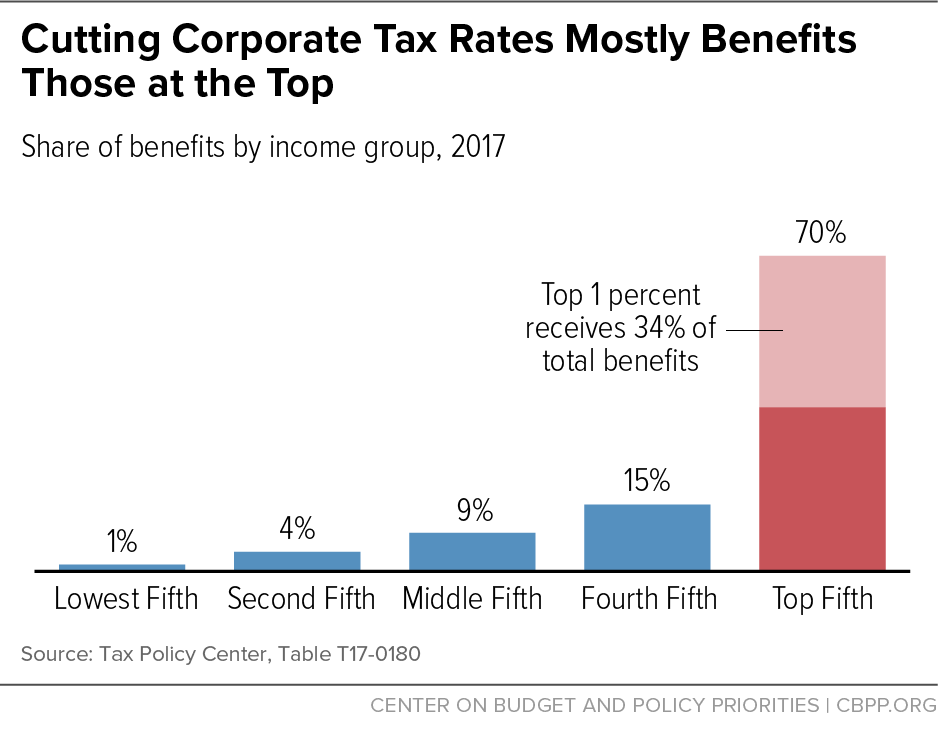

Corporate Tax Cuts Mainly Benefit Shareholders And Ceos Not Workers Center On Budget And Policy Priorities

Biden Corporate Tax Increase Details Analysis Tax Foundation